Ružica Šimić Banović is a Full Professor and Head of the Department of Economics at the Faculty of Law, University of Zagreb, where she also chairs the Career Development Committee. A CERGE-EI Foundation Fellow and member of CEPOR‘s research team, she holds advanced degrees from Harvard Kennedy School, the University of Ljubljana, and King’s College London. Continue reading Ružica Šimić Banović: Bridging Academia and Policy

Category Archives: Visiting Lecturers

Demographic Headwinds in Central and Eastern Europe

The latest public lecture to take place at CERGE-EI was presented by Andreas Tudyka of the International Monetary Fund (IMF) European Division. The topic of the report was to take a detailed look at the impact of aging populations in Central, Eastern and South Eastern European (CESEE) countries on the fiscal implications for health and pensions. Filip Pertold and Daniel Münich from the IDEA Think Tank at CERGE-EI gave the local feedback.

Continue reading Demographic Headwinds in Central and Eastern Europe

The Prague Workshop on Gender and Family in the Labor Market

Professor Shelly Lundberg (University of California at Santa Barbara) is one of the world’s most recognized professors on the topic of population economics. She was invited to Prague to give a plenary talk as part of CERGE-EI’s Prague Workshop on Gender and Family in the Labor Market (Family Environment during Childhood and Educational Gender Gap). Continue reading The Prague Workshop on Gender and Family in the Labor Market

Interview with Prof. Stephen Morris

Read our short interview with professor Stephen Morris (Princeton University), who gave a research seminar at CERGE-EI on May 9, 2019. The interview was prepared by our PhD student, Vladimír Novák.

A Fragmenting Europe in a Changing World

On 26 March 2019, Clemens Fuest of the ifo Institute at the University of Munich came to CERGE-EI for the second year in succession to present the latest EEAG report to a full audience. Prof. Fuest started by defining the fragmenting aspect in the title of this year’s report, explaining that the new Italian government that went against many of the EU rules when defining their budget last year and the ongoing Brexit negotiations have contributed to a destabilization of the EU.

Continue reading A Fragmenting Europe in a Changing WorldThose who believe in science must also fight for its values

Professor Gérard Roland (University of California, Berkeley), Visiting Professor at CERGE-EI, has been recently awarded the highest honor from the Czech Academy of Sciences. One of the most influential and successful European economists, admired among CERGE-EI community for his striking humbleness and inspiring thoughts, spoke with us about some of his recent works on China, but also about his first meeting with the co-founder of CERGE-EI, Professor Jan Svejnar. Continue reading Those who believe in science must also fight for its values

Restud Tour: 7 speakers, 2 days, 170 guests

The recent Restud Tour turned out, in many respects, to be the research event of the year for us, and we hope to keep the inspiration and ambience it created going for some time. Here is a short summary for those who could not come, including a short joint interview.

Continue reading Restud Tour: 7 speakers, 2 days, 170 guests

Perspectives on the European Economy: An Overview

On 24th of February CERGE-EI hosted a presentation, Perspectives on the European Economy, provided by the European Economic Advisory Group at CESifo. The conference explored a variety of hot topics that are examined in the EEAG Report on the European Economy 2016, which was released earlier in the week. The session included two co-authors of the report, John Driffill and Jan-Egbert Sturm, plus special guest, Kamil Galuščák of the Czech National Bank, and was chaired by Danial Münich of IDEA think-tank at CERGE-EI. Continue reading Perspectives on the European Economy: An Overview

Fiscal Policy Council: Personal Trainer or Watchdog?

This post was prepared by Geghetsik Afunts, a second year PhD student at CERGE-EI.

Do governments need a “Personal Trainer or Watchdog” to achieve objectives such as long-term sustainability of public finances, economic growth or surplus targets? Fiscal watchdogs have existed for a long time in some countries and one of the first European countries was Sweden. But the Chairman of the Swedish Fiscal Policy Council John Hassler says that in practice such institutions are considered more as personal trainers than watchdogs. Continue reading Fiscal Policy Council: Personal Trainer or Watchdog?

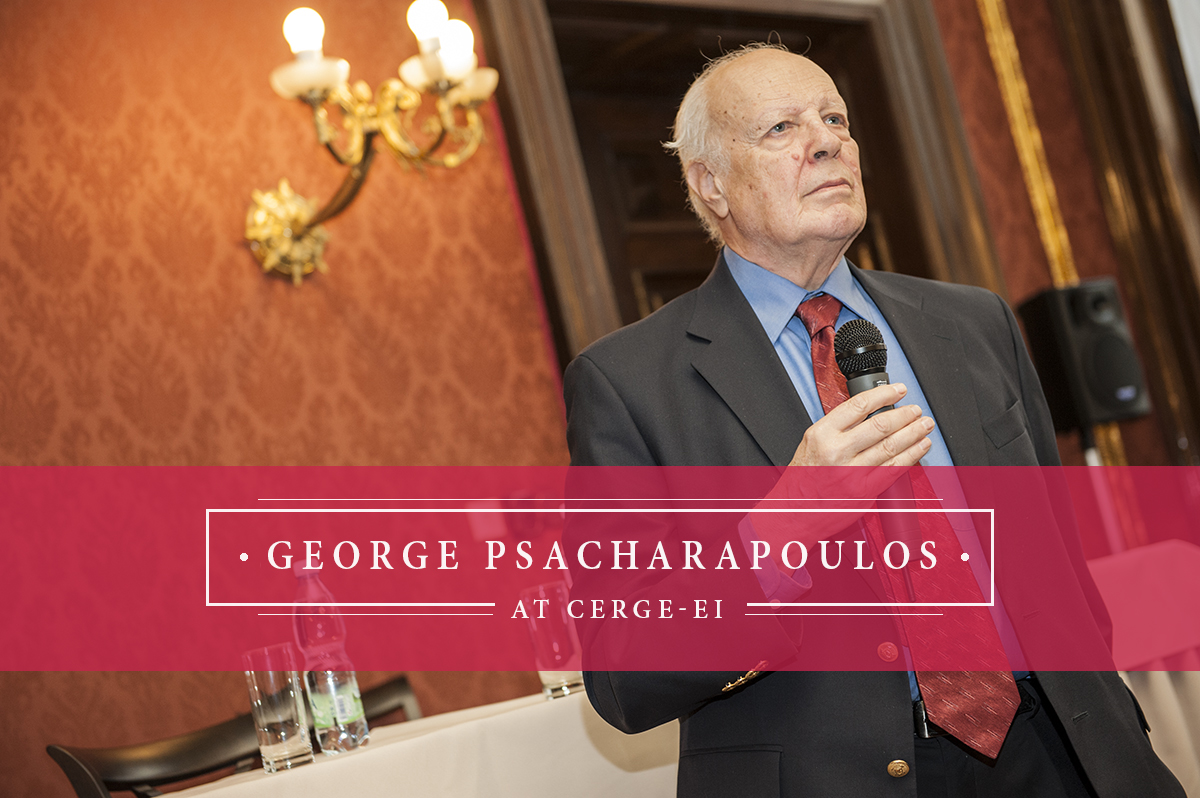

CERGE-EI Public Lecture: Sixty Years of Returns to Education with Prof. George Psacharopoulos

Over the course of his long career, George Psacharopoulos has made a deep impact on the way education is viewed from the perspective of economics. During his CERGE-EI Public Lecture on November 4th, Prof Psacharopoulos gave an interesting overview of the evolution of this research. He walked the audience through years of evolving theories and empirical evidence on the importance of education as both a personal and public investment, sharing a number of revealing facts and thoughtful insights.

See the full lecture with accompanying slides here: